NEW YORK, Feb 18 (Reuters) – Bank of America is launching an art consulting service for its wealthy clients, as new generations of collectors command changes in art auctions and more wealthy clients are using their art as collateral for loans.

Consulting firm Deloitte estimated in its latest annual report on the art market that ultra-high net worth clients held around US$2.56 trillion in art in 2024, and that figure could reach $3.5 trillion by 2030. Banks and family offices expect that around one third of those art works may be transferred to younger generations over the next decade.

More clients want to use their art collections as collateral for loans, usually to fund investment in business ventures. Around 70% of wealth managers saw higher demand for art-based loans last year and this kind of credit yields $2.3 billion in revenue, according to Deloitte.

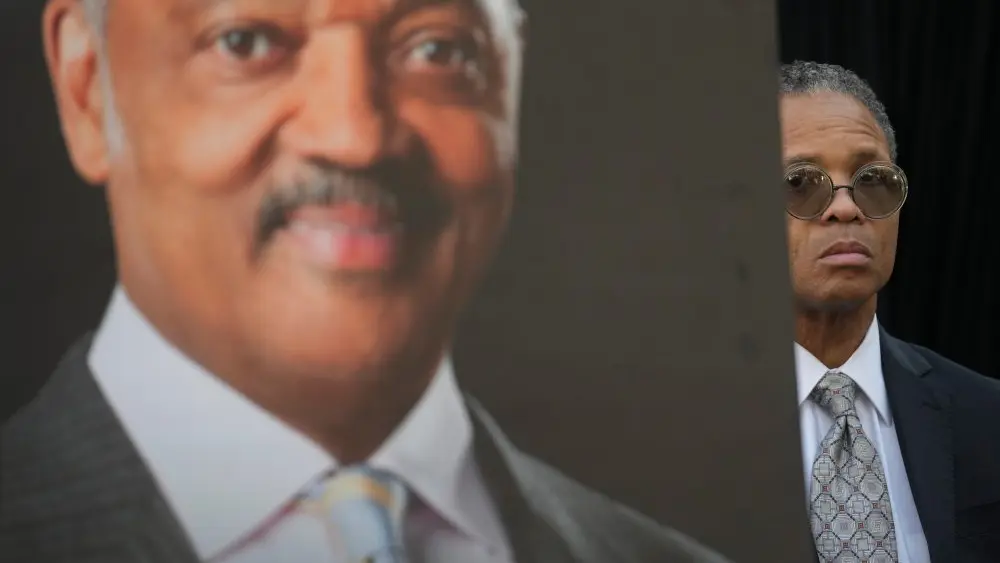

Art consultants will work with wealthy clients at Bank of America and Merrill Lynch, according to Drew Watson, Bank of America’s head of art services. Changing tastes and emergence of new collectors, either heirs or new investors, increase the need for the service, said Watson in an interview.

BofA has one of the largest art-based credit portfolios, and the new art consultancy service will help clients chose art according to their taste, but also eyeing the potential for increasing value, he said.

“It’s a very interesting moment to look for new long-term trends in the art market with all the recent change.”

Art is not seen as an asset class within the client’s investment portfolio, but as property that can be used as collateral to loans. BofA has one of the largest art-based loans portfolios and clients use the service to avoid the need to sell art to fund liquidity needs, the executive added.

(Reporting by Tatiana Bautzer; Editing by Michael Perry)

Brought to you by www.srnnews.com